Breaking News

Your nerves are like electrical cables running through your body.

Your nerves are like electrical cables running through your body.

A guy put an AI into a robot, then tricked it to get past its rules and told it to shoot him.

A guy put an AI into a robot, then tricked it to get past its rules and told it to shoot him.

China just put quantum computing on the shopping list.

China just put quantum computing on the shopping list.

Top Tech News

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Look at the genius idea he came up with using this tank that nobody wanted

Look at the genius idea he came up with using this tank that nobody wanted

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

We've wiretapped the gut-brain hotline to decode signals driving disease

We've wiretapped the gut-brain hotline to decode signals driving disease

3D-printable concrete alternative hardens in three days, not four weeks

3D-printable concrete alternative hardens in three days, not four weeks

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

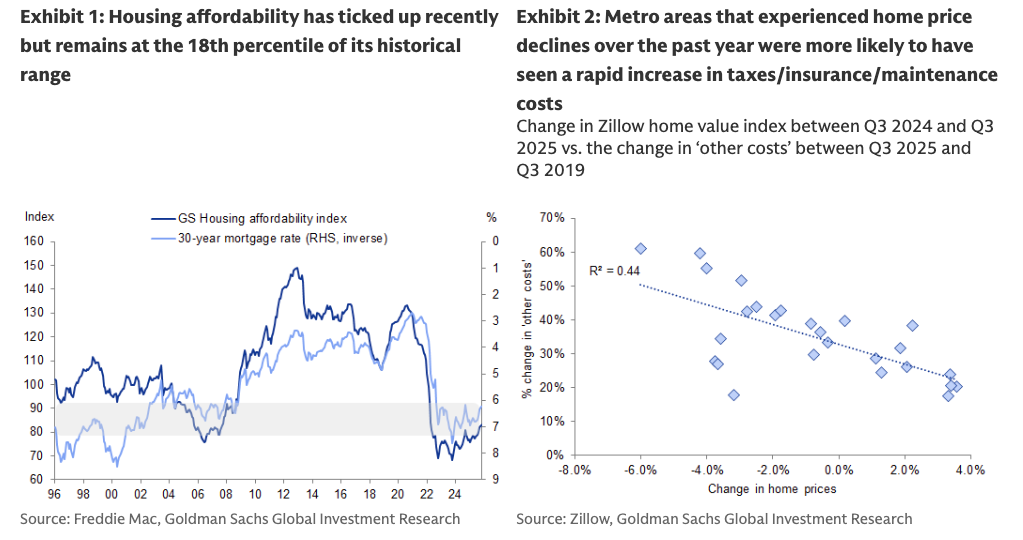

Goldman Reveals Housing "Affordability Illusion" When Factoring Other Costs

And when voters talk about "affordability," they're most concerned about the basic cost of living. Beyond food and healthcare, nothing hits harder than housing costs.

Goldman analysts led by Arun Manohar have some bad news on the housing affordability front: even with lower mortgage rates and slower home-price growth, it's largely an "illusion of affordability" once other ownership costs, such as taxes, insurance, and maintenance, are factored in.

Manohar explained more in a recent note to clients:

The most important topic of discussion in the housing market remains the challenging affordability situation. The recent decline in mortgage rates and the weak pace of HPA has resulted in housing affordability climbing to the highest level since 2022 (Exhibit 1). However, affordability remains low at the 18th percentile over the past 30 years. Although affordability has climbed, it is important to note that the standard affordability metrics do not capture all the costs of homeownership such as taxes, insurance and maintenance (collectively referred to as 'other costs'). To capture the effect of 'other costs,' we rely on estimates from Zillow for the monthly mortgage payment and total monthly payment on a new home purchased with the average interest rate of the month. The difference between the two series accounts for homeowner's insurance, property taxes, and maintenance costs. We find that metro areas that have experienced home price declines over the past year have generally witnessed greater increases in the 'other costs' over the past few years (Exhibit 2). Although falling home prices would typically make a home more affordable, prospective buyers may experience only partial relief since overall homeownership costs are not decreasing at the same rate as property values. With the median age of the US housing stock being over 40 years old, nationwide insurance premiums and maintenance expenses could increase further.

Mortgage rates are unlikely to decline enough to provide a significant boost to affordability in 2026.

What comes after?

What comes after? First totally synthetic human brain model has been realized

First totally synthetic human brain model has been realized Mach-23 potato gun to shoot satellites into space

Mach-23 potato gun to shoot satellites into space