Breaking News

BREAKING EXCLUSIVE: Globalists' Staged Coup Against Rightful President Of Romania EXPOSED

BREAKING EXCLUSIVE: Globalists' Staged Coup Against Rightful President Of Romania EXPOSED

CES 2025: 18 new products we're looking forward to this year

CES 2025: 18 new products we're looking forward to this year

Revealed: LA fire department begged for $100M to fix old trucks and replace 16 axed positions...

Revealed: LA fire department begged for $100M to fix old trucks and replace 16 axed positions...

Tulsi Gabbard, For Better or For Worse

Tulsi Gabbard, For Better or For Worse

Top Tech News

$200 gadget brings global satellite texting to any smartphone

$200 gadget brings global satellite texting to any smartphone

New Study Confirms that Cancer Cells Ferment Glutamine

New Study Confirms that Cancer Cells Ferment Glutamine

eVTOL 'flying motorcycle' promises 40 minutes of flight endurance

eVTOL 'flying motorcycle' promises 40 minutes of flight endurance

New Electric 'Donut Motor' Makes 856 HP but Weighs Just 88 Pounds

New Electric 'Donut Motor' Makes 856 HP but Weighs Just 88 Pounds

Physicists discover that 'impossible' particles could actually be real

Physicists discover that 'impossible' particles could actually be real

Is the world ready for the transformational power of fusion?

Is the world ready for the transformational power of fusion?

Solar EV gets more slippery for production-intent Las Vegas debut

Solar EV gets more slippery for production-intent Las Vegas debut

Hydrogen Finally Gets A Price Tag: S&P 500 New Energy Plays Soar Along With This Amazon Vendor

Hydrogen Finally Gets A Price Tag: S&P 500 New Energy Plays Soar Along With This Amazon Vendor

TSMC's New Arizona Fab! Apple Will Finally Make Advanced Chips In The U.S.

TSMC's New Arizona Fab! Apple Will Finally Make Advanced Chips In The U.S.

Study Reveals Key Alzheimer's Pathway - And Blocking It Reverses Symptoms in Mice

Study Reveals Key Alzheimer's Pathway - And Blocking It Reverses Symptoms in Mice

Japan Enters Its Death Spiral

Japan has been a big topic in this newsletter because it illustrates the no-win situation in which wildly overindebted countries eventually find themselves. Here are two articles that illustrate the point:

How a Country Goes Bankrupt, In 10 Steps

Now For The Death Spiral

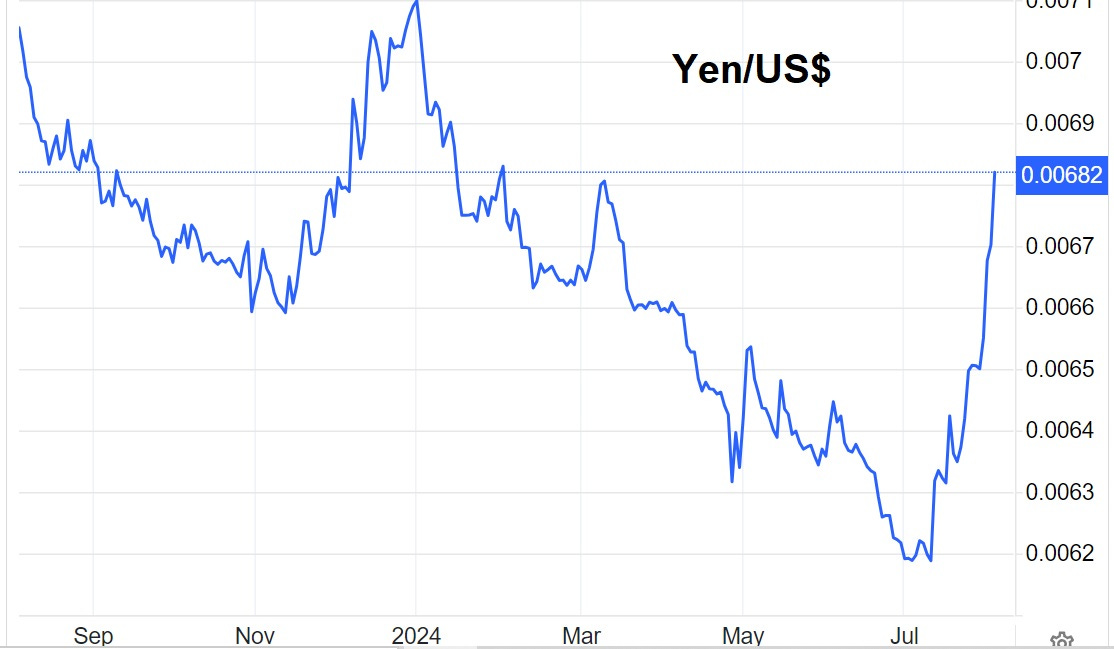

Confronted with both a plunging yen and rising interest rates, Japan was recently forced to address one of those potential crises. It chose to protect the yen by raising short-term interest rates and using the dollars in its foreign exchange reserve to buy yen. This arrested the yen's decline:

But remember, Japan is in a box where fixing one crisis exacerbates one or more others. In this case, a resurgent yen makes Japanese exports more expensive, threatening to tip the economy into recession. Japanese stocks, in response, are now plunging