Breaking News

The NWO Religion: How The Woke Postmodern "Faith" Glorifies Evil

The NWO Religion: How The Woke Postmodern "Faith" Glorifies Evil

CCP's master plan to counter Trump causes panic among Chinese officials

CCP's master plan to counter Trump causes panic among Chinese officials

Israeli Intel Coup Against Netanyahu Exposed: "Shin Bet Has Turned into a Private Militia...

Israeli Intel Coup Against Netanyahu Exposed: "Shin Bet Has Turned into a Private Militia...

Democrat Sen Chris Van Hollen Suffers Humiliating Rejection After Flying to El Salvador to Meet...

Democrat Sen Chris Van Hollen Suffers Humiliating Rejection After Flying to El Salvador to Meet...

Top Tech News

Scientists reach pivotal breakthrough in quest for limitless energy:

Scientists reach pivotal breakthrough in quest for limitless energy:

Kawasaki CORLEO Walks Like a Robot, Rides Like a Bike!

Kawasaki CORLEO Walks Like a Robot, Rides Like a Bike!

World's Smallest Pacemaker is Made for Newborns, Activated by Light, and Requires No Surgery

World's Smallest Pacemaker is Made for Newborns, Activated by Light, and Requires No Surgery

Barrel-rotor flying car prototype begins flight testing

Barrel-rotor flying car prototype begins flight testing

Coin-sized nuclear 3V battery with 50-year lifespan enters mass production

Coin-sized nuclear 3V battery with 50-year lifespan enters mass production

BREAKTHROUGH Testing Soon for Starship's Point-to-Point Flights: The Future of Transportation

BREAKTHROUGH Testing Soon for Starship's Point-to-Point Flights: The Future of Transportation

Molten salt test loop to advance next-gen nuclear reactors

Molten salt test loop to advance next-gen nuclear reactors

Quantum Teleportation Achieved Over Internet For The First Time

Quantum Teleportation Achieved Over Internet For The First Time

Watch the Jetson Personal Air Vehicle take flight, then order your own

Watch the Jetson Personal Air Vehicle take flight, then order your own

Microneedles extract harmful cells, deliver drugs into chronic wounds

Microneedles extract harmful cells, deliver drugs into chronic wounds

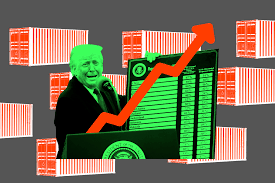

Tariffs On...

I, like many refer to them as the "Liberation Day" tariffs, as that is a talking point that seems to appeal to the President and avoids calling them "reciprocal" which they are not.

There have been some interesting "surprises" overnight.

U.S. stock futures dropped between 2% and 3% a little after midnight but are now down less than 1% or even in positive in some cases (depending on whether you focus on the S&P 500 or Nasdaq 100 futures). They are moving rapidly.

European stock markets are down 2.5% to 3% across the board.

What is interesting though, is that Chinese ETF's (KWEB, FXI) are up over 5%.

We will come back to stocks, but bonds were the big story overnight!

If you were up last night waiting to see if there was a last-minute reprieve, your social media likely got overwhelmed with stories about the bond market – with the U.S. longer dated maturities being the focal point.

The 30-year bond briefly breached 5%. The always important 10-year yield rose above 4.5% as yields marched incessantly higher from around 10 pm until just after midnight. They are currently back to 4.37%, about 7 bps higher than where they closed.

The yield story is the biggest, so here is our take on what happened:

Some large and relentless volumes went through during a period of low liquidity. Why would anyone dump treasuries overnight when the market has limited liquidity relative to the U.S. hours? Large foreign or off-shore firms all have desks to trade treasuries during U.S. hours, so it was a bit weird. Leads me to think someone either was trying to "make a statement" or someone was trying to push markets and trigger stops (seems plausible). So in any case, while the move was eye-opening, I dismiss some of it, as it seems to have been done with intention.

To a large degree, this was a global phenomenon. Most major countries (except for Germany – which is the EU "safe haven") moved higher. Though not to the extent the U.S. did and certainly not with the same level of focus from market watchers.

Could this be foreign selling of bonds? China has come up as a culprit in the selling. Maybe other countries were selling bonds overnight to "hurt" the U.S., but that doesn't seem that likely. As mentioned already, anyone with size, probably does the bulk of their trading during U.S. hours. I cannot think of many entities who have large exposure to U.S. bonds (large enough to move markets) that doesn't transact primarily during U.S. hours. So I'm not sure this theory holds much water for the overnight move.