Breaking News

Food Banks All Over The U.S. Are Being Overwhelmed By A Tsunami Of Hungry People

Food Banks All Over The U.S. Are Being Overwhelmed By A Tsunami Of Hungry People

Kids' Online Safety Laws Could Dig a Graveyard for Speech and Privacy

Kids' Online Safety Laws Could Dig a Graveyard for Speech and Privacy

The Only REAL Solution to Digital ID - #SolutionsWatch

The Only REAL Solution to Digital ID - #SolutionsWatch

Top Tech News

Japan just injected artificial blood into a human. No blood type needed. No refrigeration.

Japan just injected artificial blood into a human. No blood type needed. No refrigeration.

The 6 Best LLM Tools To Run Models Locally

The 6 Best LLM Tools To Run Models Locally

Testing My First Sodium-Ion Solar Battery

Testing My First Sodium-Ion Solar Battery

A man once paralyzed from the waist down now stands on his own, not with machines or wires,...

A man once paralyzed from the waist down now stands on his own, not with machines or wires,...

Review: Thumb-sized thermal camera turns your phone into a smart tool

Review: Thumb-sized thermal camera turns your phone into a smart tool

Army To Bring Nuclear Microreactors To Its Bases By 2028

Army To Bring Nuclear Microreactors To Its Bases By 2028

Nissan Says It's On Track For Solid-State Batteries That Double EV Range By 2028

Nissan Says It's On Track For Solid-State Batteries That Double EV Range By 2028

Carbon based computers that run on iron

Carbon based computers that run on iron

Russia flies strategic cruise missile propelled by a nuclear engine

Russia flies strategic cruise missile propelled by a nuclear engine

100% Free AC & Heat from SOLAR! Airspool Mini Split AC from Santan Solar | Unboxing & Install

100% Free AC & Heat from SOLAR! Airspool Mini Split AC from Santan Solar | Unboxing & Install

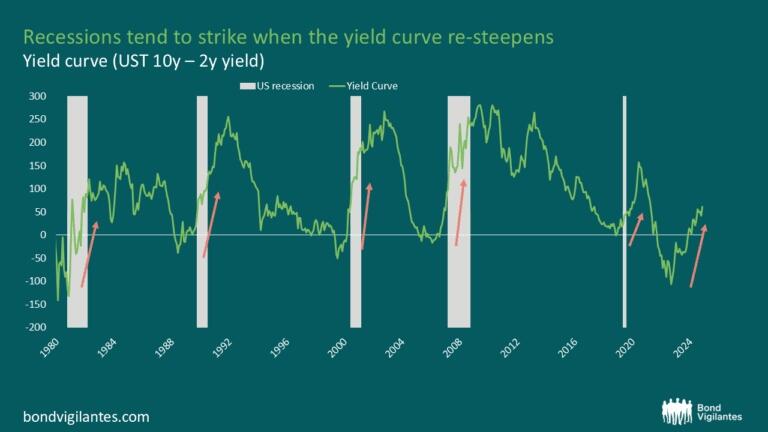

Recession Watch: Could The Next One Be Right Around The Corner

Authored by Carlo Putti via BondVigilantes.com,

Recessions often appear crystal clear when analysed in retrospect.

It's easy to sit back, glance at the Bloomberg screen, and spot the evident recession we had in 2008 or the dot-com bubble of 2000.

However, discerning whether an economy is on the brink of a recession, or even if it is already are in one, is considerably more challenging. Recessions often become obvious only once they are well underway, and by then, significant economic damage may have occurred. For instance, during the GFC (Great Financial Crisis), many viewed Lehman Brothers' collapse in September 2008 and the simultaneous surge in unemployment as the onset of the recession. However, the recession started almost a year earlier in the fourth quarter of 2007. This shows that by the time most people realise there's a recession, it is typically already in full swing. Additionally, macroeconomic data poses another challenge in early recession identification because it tends to be lagging and subject to sharp revisions, altering the perceived state of the economy. Looking back at the GFC, labour market data in early 2008 still was showing a picture of positive job growth, suggesting economic robustness. It was only after subsequent revisions that these numbers were adjusted to reflect negative job growth, exposing the real extent of economic deterioration. These dynamics highlight why recessions seem obvious only after substantial damage has unfolded.

"Refusal to Disclose"

"Refusal to Disclose"