Breaking News

"We Have To Respond With Force & Strength. We Have To Be Vicious, Just Like They Are":

"We Have To Respond With Force & Strength. We Have To Be Vicious, Just Like They Are":

US Air Force's first official autonomous combat drone takes to the air

US Air Force's first official autonomous combat drone takes to the air

Cracker Barrel suspends all restaurant remodels after disastrous rebrand controversy

Cracker Barrel suspends all restaurant remodels after disastrous rebrand controversy

The moment Israel bombs Hamas leaders as they discuss Trump's Gaza ceasefire deal in Qatar:

The moment Israel bombs Hamas leaders as they discuss Trump's Gaza ceasefire deal in Qatar:

Top Tech News

Methylene chloride (CH2Cl?) and acetone (C?H?O) create a powerful paint remover...

Methylene chloride (CH2Cl?) and acetone (C?H?O) create a powerful paint remover...

Engineer Builds His Own X-Ray After Hospital Charges Him $69K

Engineer Builds His Own X-Ray After Hospital Charges Him $69K

Researchers create 2D nanomaterials with up to nine metals for extreme conditions

Researchers create 2D nanomaterials with up to nine metals for extreme conditions

The Evolution of Electric Motors: From Bulky to Lightweight, Efficient Powerhouses

The Evolution of Electric Motors: From Bulky to Lightweight, Efficient Powerhouses

3D-Printing 'Glue Gun' Can Repair Bone Fractures During Surgery Filling-in the Gaps Around..

3D-Printing 'Glue Gun' Can Repair Bone Fractures During Surgery Filling-in the Gaps Around..

Kevlar-like EV battery material dissolves after use to recycle itself

Kevlar-like EV battery material dissolves after use to recycle itself

Laser connects plane and satellite in breakthrough air-to-space link

Laser connects plane and satellite in breakthrough air-to-space link

Lucid Motors' World-Leading Electric Powertrain Breakdown with Emad Dlala and Eric Bach

Lucid Motors' World-Leading Electric Powertrain Breakdown with Emad Dlala and Eric Bach

Murder, UFOs & Antigravity Tech -- What's Really Happening at Huntsville, Alabama's Space Po

Murder, UFOs & Antigravity Tech -- What's Really Happening at Huntsville, Alabama's Space Po

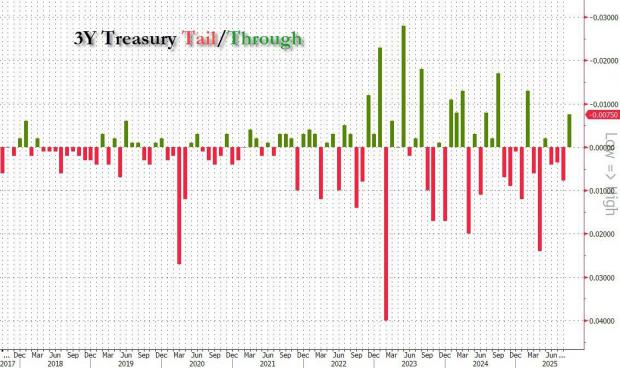

Stellar 3Y Auction Blows Away Expectations With Huge Stop-Through, Near Record Foreign Demand...

With interest rates in freefall in recent days, but reversing modestly this morning, traders were wondering if today's auction of $58BN in 3 year paper would accentuate the modest reversal or extend on the positive momentum observed over the past week. The answer was resoundingly the latter, and here's why.

First, the auction stopped at high yield of 3.485%, down sharply from 3.669% last month, and the lowest since Sept 2024 when the Fed was about to cut rates by a jumbo 50bps on another huge downward jobs revision print. The auction stopped through the When Issued 3.492% by 0.7bps, and following 3 straight tailing auctions, was the biggest through since Feb 2025.

The bid to cover was an impressive 2.726%, up 20bps from August and the highest since February.

The internals were even more impressive, with Indirects taking down a near record 74.24%, up from 53.99% in August and the 2nd highest on record!

And with Directs awarded 17.39%, Dealers were left with just 8.37%, the lowest on record.

Overall this was a blowout 3Y auction, easily one of the top 3 on record, and the bond market certainly liked it: with yields moving higher after today's record negative revision (on expecations of steepening that will follow the inflation that rate cuts usher in) we have seen renewed buying across the curve.

Tiny briefcase engine boosts EV range beyond battery power

Tiny briefcase engine boosts EV range beyond battery power