Breaking News

War on Words: Both Parties Try to Silence Speech They Don't Like

War on Words: Both Parties Try to Silence Speech They Don't Like

Low Interest Rates Don't Have the Stimulus the Economy Craves

Low Interest Rates Don't Have the Stimulus the Economy Craves

"What's About To Happen Is Not A Coincidence" | Whitney Webb

"What's About To Happen Is Not A Coincidence" | Whitney Webb

Future of Satellite of Direct to Cellphone

Future of Satellite of Direct to Cellphone

Top Tech News

3D Printed Aluminum Alloy Sets Strength Record on Path to Lighter Aircraft Systems

3D Printed Aluminum Alloy Sets Strength Record on Path to Lighter Aircraft Systems

Big Brother just got an upgrade.

Big Brother just got an upgrade.

SEMI-NEWS/SEMI-SATIRE: October 12, 2025 Edition

Stem Cell Breakthrough for People with Parkinson's

Stem Cell Breakthrough for People with Parkinson's

Linux Will Work For You. Time to Dump Windows 10. And Don't Bother with Windows 11

Linux Will Work For You. Time to Dump Windows 10. And Don't Bother with Windows 11

XAI Using $18 Billion to Get 300,000 More Nvidia B200 Chips

XAI Using $18 Billion to Get 300,000 More Nvidia B200 Chips

Immortal Monkeys? Not Quite, But Scientists Just Reversed Aging With 'Super' Stem Cells

Immortal Monkeys? Not Quite, But Scientists Just Reversed Aging With 'Super' Stem Cells

ICE To Buy Tool That Tracks Locations Of Hundreds Of Millions Of Phones Every Day

ICE To Buy Tool That Tracks Locations Of Hundreds Of Millions Of Phones Every Day

Yixiang 16kWh Battery For $1,920!? New Design!

Yixiang 16kWh Battery For $1,920!? New Design!

Find a COMPATIBLE Linux Computer for $200+: Roadmap to Linux. Part 1

Find a COMPATIBLE Linux Computer for $200+: Roadmap to Linux. Part 1

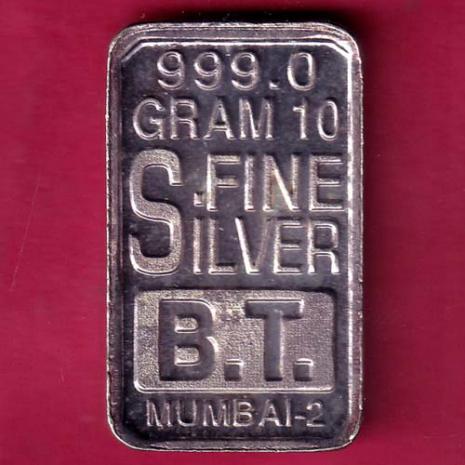

India's Largest Metals Refinery Ran Out of Silver for the First Time in History

Sold Out in India, Panic in London

Bloomberg comments How the Silver Market Broke

Key Takeaways

Vipin Raina's company, India's largest precious metals refinery, ran out of silver stock for the first time in its history due to high demand from Indian customers.

The shortages in India were soon felt globally, with the London silver market also running out of available metal, and traders describing a market that was "all but broken".

The silver market crisis was caused by a combination of factors, including a multi-year solar power boom, a rush to ship metal to the US to beat possible tariffs, and a sudden spike in demand from India, particularly during the Diwali holiday season.

For months, Vipin Raina had been bracing for a stampede of buying from Indian customers loading up on silver to honor the Hindu goddess of wealth.

But when it came, he was still blown away. At the start of last week, his company, India's largest precious metals refinery, ran out of silver stock for the first time in its history.

"Most people who are dealing silver and silver coins, they're literally out of stock because silver is not there," said Raina, who is head of trading at MMTC-Pamp India Pvt. "This kind of crazy market — where people are buying at these levels — I have not seen in my 27-year career."

Within days, the shortages were being felt not just in India, but around the world. India's festival buyers were joined by international investors and hedge funds piling into precious metals as a bet on the fragility of the US dollar — or simply to follow the market's irrepressible surge higher.

By the end of last week, the frenzy had rippled across to the London silver market, where global prices are set and where the world's biggest banks buy and sell in huge quantities. Now, it had run out of available metal. Traders describe a market that was all but broken, where even large banks stepped back from quoting prices as they fielded repeated calls from clients yelling down the line in frustration and exhaustion.