Breaking News

Will Trump End Sham Democracy Promotions?

Will Trump End Sham Democracy Promotions?

Review: Thumb-sized thermal camera turns your phone into a smart tool

Review: Thumb-sized thermal camera turns your phone into a smart tool

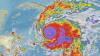

Americans stranded in Jamaica plea for help as 'worst ever hurricane' to slam Caribbean isla

Americans stranded in Jamaica plea for help as 'worst ever hurricane' to slam Caribbean isla

Urgent warning to Gmail users as 183 MILLION passwords are stolen in data breach...

Urgent warning to Gmail users as 183 MILLION passwords are stolen in data breach...

Top Tech News

Graphene Dream Becomes a Reality as Miracle Material Enters Production for Better Chips, Batteries

Graphene Dream Becomes a Reality as Miracle Material Enters Production for Better Chips, Batteries

Virtual Fencing May Allow Thousands More Cattle to Be Ranched on Land Rather Than in Barns

Virtual Fencing May Allow Thousands More Cattle to Be Ranched on Land Rather Than in Barns

Prominent Personalities Sign Letter Seeking Ban On 'Development Of Superintelligence'

Prominent Personalities Sign Letter Seeking Ban On 'Development Of Superintelligence'

Why 'Mirror Life' Is Causing Some Genetic Scientists To Freak Out

Why 'Mirror Life' Is Causing Some Genetic Scientists To Freak Out

Retina e-paper promises screens 'visually indistinguishable from reality'

Retina e-paper promises screens 'visually indistinguishable from reality'

Scientists baffled as interstellar visitor appears to reverse thrust before vanishing behind the sun

Scientists baffled as interstellar visitor appears to reverse thrust before vanishing behind the sun

Future of Satellite of Direct to Cellphone

Future of Satellite of Direct to Cellphone

Amazon goes nuclear with new modular reactor plant

Amazon goes nuclear with new modular reactor plant

China Is Making 800-Mile EV Batteries. Here's Why America Can't Have Them

China Is Making 800-Mile EV Batteries. Here's Why America Can't Have Them

Andrei Jikh Says China Is Using Gold To Replace the US Dollar

China built the Shanghai Gold Exchange, which is already the biggest physical gold marketplace in the world. The 'gold corridor' is a network of vaults across the BRICS countries that will allow those countries that hold the yuan to exchange it 1:15 for physical gold. China's currency will have trust that has been lost with the USD. Gold has been reclassified as a Basel 3 Tier 1 Asset that counts the same as cash or treasuries on a bank's balance sheet. Gold is likely to be upgraded again to what's called an HQLA, a high quality liquid asset. That one change can unlock gold's full potential that will let countries use it for something called repo and financing, which is the foundation of the entire financial system.

The 'gold corridor' is a network of vaults across the BRICS countries that will allow those countries that hold the yuan to exchange it 1:15 for physical gold. China's currency will have trust that has been lost with the USD. Gold has been reclassified as a Basel 3 Tier 1 Asset that counts the same as cash or treasuries on a bank's balance sheet. Gold is likely to be upgraded again to what's called an HQLA, a high quality liquid asset. That one change can unlock gold's full potential that will let countries use it for something called repo and financing, which is the foundation of the entire financial system.

If gold becomes HQLA, countries will not need US dollars to finance their economies anymore. The gold corridor vaults make the metal accessible for countries trading in yuan. China plans to price gold at an average rather than a daily price to make it less volatile. China will help developing nations that need infrastructure by giving them loans based on their resources. China then gets to finance development and build influence, helping developing countries to skirt the West, the IMF, and the International Monetary Fund while using gold as a high quality liquid asset.

China Innovates: Transforming Sand into Paper

China Innovates: Transforming Sand into Paper