Breaking News

THE PARTY'S OVER: Party City Going Out of Business After 40 Years

THE PARTY'S OVER: Party City Going Out of Business After 40 Years

Never Underestimate The Power Of Unfinished Business

Never Underestimate The Power Of Unfinished Business

Judge Rejects Federal Government Request, Allows Derek Chauvin To Examine George Floyd's Heart

Judge Rejects Federal Government Request, Allows Derek Chauvin To Examine George Floyd's Heart

Dangerous Waiting Game: "Debt Debate" With Two Interventionist Parties

Dangerous Waiting Game: "Debt Debate" With Two Interventionist Parties

Top Tech News

"I am Exposing the Whole Damn Thing!" (MIND BLOWING!!!!) | Randall Carlson

"I am Exposing the Whole Damn Thing!" (MIND BLOWING!!!!) | Randall Carlson

Researchers reveal how humans could regenerate lost body parts

Researchers reveal how humans could regenerate lost body parts

Antimatter Propulsion Is Still Far Away, But It Could Change Everything

Antimatter Propulsion Is Still Far Away, But It Could Change Everything

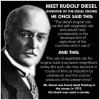

Meet Rudolph Diesel, inventor of the diesel engine

Meet Rudolph Diesel, inventor of the diesel engine

China Looks To Build The Largest Human-Made Object In Space

China Looks To Build The Largest Human-Made Object In Space

Ferries, Planes Line up to Purchase 'Solar Diesel' a Cutting-Edge Low-Carbon Fuel...

Ferries, Planes Line up to Purchase 'Solar Diesel' a Cutting-Edge Low-Carbon Fuel...

"UK scientists have created an everlasting battery in a diamond

"UK scientists have created an everlasting battery in a diamond

First look at jet-powered VTOL X-plane for DARPA program

First look at jet-powered VTOL X-plane for DARPA program

Billions of People Could Benefit from This Breakthrough in Desalination That Ensures...

Billions of People Could Benefit from This Breakthrough in Desalination That Ensures...

Tiny Wankel engine packs a power punch above its weight class

Tiny Wankel engine packs a power punch above its weight class

BIS proposes hybrid retail CBDC model blending central bank oversight with private sector roles

The Bank for International Settlements (BIS) has unveiled a comprehensive framework for designing retail central bank digital currencies (CBDCs), emphasizing a hybrid model that integrates central bank control with private sector collaboration.

Developed by the Consultative Group on Innovation and the Digital Economy (CGIDE), the report provides a roadmap for central banks in the Americas and globally as they explore this evolving financial tool.

Hybrid model

The hybrid approach proposed in the report enables central banks to retain governance over CBDC issuance and infrastructure while delegating user-facing responsibilities to private intermediaries.

These intermediaries would handle functions such as Know Your Customer (KYC) verification, wallet management, and transaction facilitation. This model ensures efficiency and scalability while addressing concerns about user privacy and compliance with anti-money laundering (AML) regulations.

The architecture includes four core processes: user enrollment, CBDC issuance (cash-in), CBDC withdrawal (cash-out), and intra-ledger transfers.

Notably, the system supports tiered KYC mechanisms, offering basic wallets for low-value transactions with minimal identity requirements and advanced wallets for higher-value transactions under stricter regulatory standards.

Offline payment capabilities, a significant feature of the proposal, aim to expand access to underserved and unbanked populations. According to the report:

"The hybrid model bridges the gap between centralization and decentralization, offering resilience, accessibility, and enhanced privacy protections."