Breaking News

Creating the First Synthetic Human D.N.A From Scratch

Creating the First Synthetic Human D.N.A From Scratch

Texas Ready for $10M Bitcoin Purchase After Governor Signs Bill for State Reserve

Texas Ready for $10M Bitcoin Purchase After Governor Signs Bill for State Reserve

How do you feel about this use of AI

How do you feel about this use of AI

Big Tech Executives Welcomed as Army Colonels, New Government AI Project Leaked

Big Tech Executives Welcomed as Army Colonels, New Government AI Project Leaked

Top Tech News

xAI Grok 3.5 Renamed Grok 4 and Has Specialized Coding Model

xAI Grok 3.5 Renamed Grok 4 and Has Specialized Coding Model

AI goes full HAL: Blackmail, espionage, and murder to avoid shutdown

AI goes full HAL: Blackmail, espionage, and murder to avoid shutdown

BREAKING UPDATE Neuralink and Optimus

BREAKING UPDATE Neuralink and Optimus

1900 Scientists Say 'Climate Change Not Caused By CO2' – The Real Environment Movement...

1900 Scientists Say 'Climate Change Not Caused By CO2' – The Real Environment Movement...

New molecule could create stamp-sized drives with 100x more storage

New molecule could create stamp-sized drives with 100x more storage

DARPA fast tracks flight tests for new military drones

DARPA fast tracks flight tests for new military drones

ChatGPT May Be Eroding Critical Thinking Skills, According to a New MIT Study

ChatGPT May Be Eroding Critical Thinking Skills, According to a New MIT Study

How China Won the Thorium Nuclear Energy Race

How China Won the Thorium Nuclear Energy Race

Sunlight-Powered Catalyst Supercharges Green Hydrogen Production by 800%

Sunlight-Powered Catalyst Supercharges Green Hydrogen Production by 800%

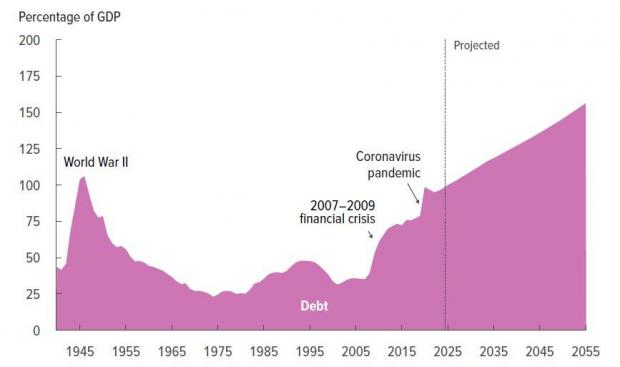

Senate Version Of Trump Tax Bill Adds $3.3 Trillion To Deficit, $500BN More Than The House;

The Senate version of President Trump's Big, Beautiful Bill (BBB) will add nearly $3.3 trillion to US deficits over a decade, according to the latest estimate from the Congressional Budget Office, half a trillion more than the $2.8 trillion in deficit expansion under the House version of the same bill. That's from a starting point with debt to GDP already in excess of 120% and the fiscal deficit sitting close to a peacetime record.

The CBO score for the so-called One Big Beautiful Bill reflects a $4.5 trillion decrease in revenues (i.e. tax cuts relative to the pre-TCJA baseline) and a $1.2 trillion decrease in spending through 2034, relative to a current law baseline.

The Senate bill, by Republican request, was also scored as saving $508 billion over a decade relative to a current policy baseline. The party's lawmakers have sought to use the accounting maneuver to permanently extend President Donald Trump's 2017 income-tax cuts, and score them as costing nothing.

While this approach is expected to pass, it effectively dooms the US to debt collapse as every subsequent administration will use the same tactic from now on and pretend that trillions in incremental spending every 4 years are really just an extension of the baseline. Meanwhile, the US is set to hit $40 trillion in debt in less than 2 years.

What does this mean? It means that Senate Republicans slapped a price tag on their tax package that is nearly 90% lower than the version that recently passed the House. They didn't bring the price down by changing the policies in the One Big Beautiful Bill. Instead, the Senate simply changed the way they did the math.

Senate Republicans are using a new method to estimate the costs of their tax package that ignores the price of continuing any tax policy in effect when the bill is passed. That method of accounting, called the "current policy" baseline, lets the Senate advertise President Donald Trump's tax package at one-tenth of its impact on the nation's finances as estimated by Congress's usual way of counting costs. If the costs were estimated in the traditional way, the Senate's proposed tax package would add $4.2 trillion to the national debt, according to preliminary estimates from the nonpartisan Committee for a Responsible Federal Budget.

He 3D Printed a Whole House

He 3D Printed a Whole House