Breaking News

Tariff-Driven Rally Reverses In Lumber Market

Tariff-Driven Rally Reverses In Lumber Market

New Jersey declares State of Emergency as Hurricane Erin barrels up East Coast

New Jersey declares State of Emergency as Hurricane Erin barrels up East Coast

Ron Paul Cured My Apathy by Karen Kwiatkowski

Ron Paul Cured My Apathy by Karen Kwiatkowski

How Did $31,485 Become "Affordable"?

How Did $31,485 Become "Affordable"?

Top Tech News

Chinese Scientists Produce 'Impossible' Steel to Line Nuclear Fusion Reactors in Major Break

Chinese Scientists Produce 'Impossible' Steel to Line Nuclear Fusion Reactors in Major Break

1,000 miles: EV range world record demolished ... by a pickup truck

1,000 miles: EV range world record demolished ... by a pickup truck

Fermented Stevia Extract Kills Pancreatic Cancer Cells In Lab Tests

Fermented Stevia Extract Kills Pancreatic Cancer Cells In Lab Tests

3D printing set to slash nuclear plant build times & costs

3D printing set to slash nuclear plant build times & costs

You can design the wheels for NASA's next moon vehicle with the 'Rock and Roll Challenge

You can design the wheels for NASA's next moon vehicle with the 'Rock and Roll Challenge

'Robot skin' beats human reflexes, transforms grip with fabric-powered touch

'Robot skin' beats human reflexes, transforms grip with fabric-powered touch

World's first nuclear fusion plant being built in US to power Microsoft data centers

World's first nuclear fusion plant being built in US to power Microsoft data centers

The mitochondria are more than just the "powerhouse of the cell" – they initiate immune...

The mitochondria are more than just the "powerhouse of the cell" – they initiate immune...

Historic Aviation Engine Advance to Unlock Hypersonic Mach 10 Planes

Historic Aviation Engine Advance to Unlock Hypersonic Mach 10 Planes

OpenAI CEO Sam Altman Pitches Eyeball-Scanning World ID to Bankers

OpenAI CEO Sam Altman Pitches Eyeball-Scanning World ID to Bankers

Tariff-Driven Rally Reverses In Lumber Market

There is some good news in the lumber market: contracts have plunged more than 14% in recent weeks, reversing highs last seen during the pandemic shortages. The sharp reversal comes as bets on tariff-driven cost pressures and lower interest rates failed to lift demand. At the same time, disappointing housing data and weak earnings across the housing industry underscored the trouble festering.

Traders ramped up bets that U.S. tariffs on Canadian imports and lower interest rates would lift costs and demand, but housing activity has failed to deliver any demand tailwinds.

There has been weak builder confidence (hitting 13-year lows), disappointing housing permits, and earnings misses at Home Depot, James Hardie Industries, Builders FirstSource, and UFP Industries.

Earlier today...

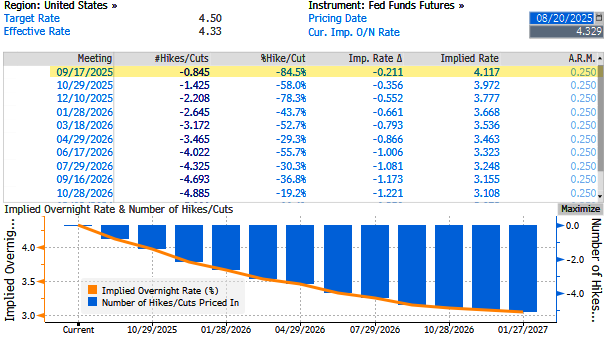

Why is the housing market completely frozen? A new 30Y mortgage costs 6.80%. The average existing mortgage is almost 3% lower, or 4.11%. https://t.co/hOcBSnWZre pic.twitter.com/ctJozi9CGI

— zerohedge (@zerohedge) August 21, 2025