Breaking News

How Close Were Iran Negotiations Before Trump Flipped the Table?

How Close Were Iran Negotiations Before Trump Flipped the Table?

Peter Schiff: It's Time to Axe Entitlements

Peter Schiff: It's Time to Axe Entitlements

The First Automated Rammed Earth House Building Machine - Form Earth

The First Automated Rammed Earth House Building Machine - Form Earth

We Build and Test Microwave Blocking Panels - Invisible to Radar

We Build and Test Microwave Blocking Panels - Invisible to Radar

Top Tech News

US particle accelerators turn nuclear waste into electricity, cut radioactive life by 99.7%

US particle accelerators turn nuclear waste into electricity, cut radioactive life by 99.7%

Blast Them: A Rutgers Scientist Uses Lasers to Kill Weeds

Blast Them: A Rutgers Scientist Uses Lasers to Kill Weeds

H100 GPUs that cost $40,000 new are now selling for around $6,000 on eBay, an 85% drop.

H100 GPUs that cost $40,000 new are now selling for around $6,000 on eBay, an 85% drop.

We finally know exactly why spider silk is stronger than steel.

We finally know exactly why spider silk is stronger than steel.

She ran out of options at 12. Then her own cells came back to save her.

She ran out of options at 12. Then her own cells came back to save her.

A cardiovascular revolution is silently unfolding in cardiac intervention labs.

A cardiovascular revolution is silently unfolding in cardiac intervention labs.

DARPA chooses two to develop insect-size robots for complex jobs like disaster relief...

DARPA chooses two to develop insect-size robots for complex jobs like disaster relief...

Multimaterial 3D printer builds fully functional electric motor from scratch in hours

Multimaterial 3D printer builds fully functional electric motor from scratch in hours

WindRunner: The largest cargo aircraft ever to be built, capable of carrying six Chinooks

WindRunner: The largest cargo aircraft ever to be built, capable of carrying six Chinooks

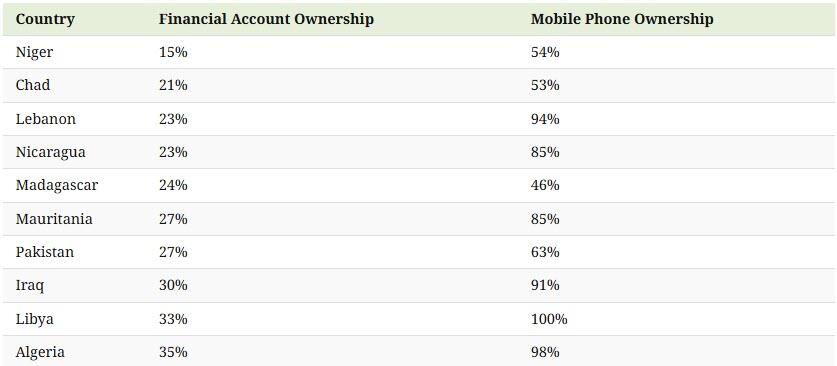

Unbanked In A Connected World

This contrast between connectivity and financial access highlights both the persistent gaps in global inclusion and the massive opportunity to close them.

Created in partnership with Plasma, this graphic, via Visual Capitalist's Jenna Ross, shows how ownership of financial accounts and mobile phones compares across countries. It's part of our Money 2.0 series, where we highlight how finance is evolving into its next era.

The Unbanked Gap

In low- and middle-income economies, 84% of adults own a mobile phone, while 75% of people have financial accounts. This gap is much wider in some countries, especially in Africa and the Middle East.

For the most unbanked countries worldwide, here are the percentages of adults who own a financial account and those who own a mobile phone.

RNA Crop Spray: Should We Be Worried?

RNA Crop Spray: Should We Be Worried?