Breaking News

SEMI-NEWS/SEMI-SATIRE: January 11, 2026 Edition

"Appalling": Debanking Explodes To Record High In Britain

"Appalling": Debanking Explodes To Record High In Britain

MTG explodes in astonishing f-bomb laden tirade as Trump orders Secret Service probe:

MTG explodes in astonishing f-bomb laden tirade as Trump orders Secret Service probe:

"World's Criminals On Notice": Trump's Gunboat Diplomacy Seizes Another Tanker In

"World's Criminals On Notice": Trump's Gunboat Diplomacy Seizes Another Tanker In

Top Tech News

World's most powerful hypergravity machine is 1,900X stronger than Earth

World's most powerful hypergravity machine is 1,900X stronger than Earth

New battery idea gets lots of power out of unusual sulfur chemistry

New battery idea gets lots of power out of unusual sulfur chemistry

Anti-Aging Drug Regrows Knee Cartilage in Major Breakthrough That Could End Knee Replacements

Anti-Aging Drug Regrows Knee Cartilage in Major Breakthrough That Could End Knee Replacements

Scientists say recent advances in Quantum Entanglement...

Scientists say recent advances in Quantum Entanglement...

Solid-State Batteries Are In 'Trailblazer' Mode. What's Holding Them Up?

Solid-State Batteries Are In 'Trailblazer' Mode. What's Holding Them Up?

US Farmers Began Using Chemical Fertilizer After WW2. Comfrey Is a Natural Super Fertilizer

US Farmers Began Using Chemical Fertilizer After WW2. Comfrey Is a Natural Super Fertilizer

Kawasaki's four-legged robot-horse vehicle is going into production

Kawasaki's four-legged robot-horse vehicle is going into production

The First Production All-Solid-State Battery Is Here, And It Promises 5-Minute Charging

The First Production All-Solid-State Battery Is Here, And It Promises 5-Minute Charging

See inside the tech-topia cities billionaires are betting big on developing...

See inside the tech-topia cities billionaires are betting big on developing...

The Interventions Aren't Working Any More

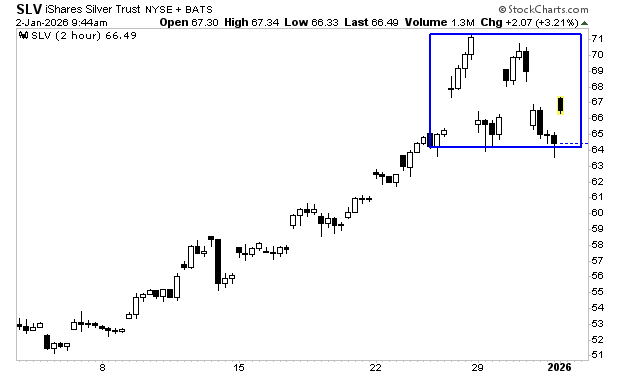

As I noted earlier this week, rumors are swirling that a large, systemically important financial institution is being forced to liquidate its precious metal short positions. We get strong evidence of this from the CME Group which has suspiciously raised margins on precious metals futures trading for the SECOND time in one week (first on December 26 and again on December 31st).

The CME raises margins in this fashion whenever it begins to lose control of the precious metals market and is desperate to "flush out" a lot of positions. The fact it has done this TWICE in the last week alone suggests us someone "big" is likely on the wrong side of the precious metals trade.

The interventions aren't working, either.

Despite these two margin hikes, precious metals continue to hold up. As I write this, silver is catching another bid. When you look at the chart the precious metal has held critical support at $64 per ounce multiple times. This indicates the current volatility is in fact a consolidation, NOT the end of the bull market.

I would also note that the Bank Index is beginning to collapse. Again, between this and the price action in precious metals, it appears "someone" big is in serious trouble behind the scenes.

Big Picture: precious metals are signaling something MAJOR is coming down the pike in our financial system. When even a large-scale liquidation can't stop silver or gold from rallying you KNOW it's time to back up the truck!

Those investors who are correctly positioned for this could generate life-changing returns.

On that note, our Special Investment Report titled Survive the Inflationary Storm details FIVE secret investments you can use to potentially make extraordinary gains. These are HIGH OCTANE positions that rose 75%, 140%, 150%, 180%, 280% and an incredible 574% in 2025! And I wouldn't br surprised to see them REPEAT this performance in 2026.

Normally I'd charge $499 for this report as a standalone item, but we in light of what is unfolding today, we making just 100 copies available to the public.

Storage doesn't get much cheaper than this

Storage doesn't get much cheaper than this