Breaking News

Exclusive -- The Last Education Secretary: Linda McMahon on Putting Herself Out of a Job

Exclusive -- The Last Education Secretary: Linda McMahon on Putting Herself Out of a Job

Inflation Watch: Countries Losing The Most Purchasing Power In 2025

Inflation Watch: Countries Losing The Most Purchasing Power In 2025

US & Qatar Force EU Climate Policy U-Turn – End of the ESG Era?

US & Qatar Force EU Climate Policy U-Turn – End of the ESG Era?

Top Tech News

New Gel Regrows Dental Enamel–Which Humans Cannot Do–and Could Revolutionize Tooth Care

New Gel Regrows Dental Enamel–Which Humans Cannot Do–and Could Revolutionize Tooth Care

Researchers want to drop lab grown brains into video games

Researchers want to drop lab grown brains into video games

Scientists achieve breakthrough in Quantum satellite uplink

Scientists achieve breakthrough in Quantum satellite uplink

Blue Origin New Glenn 2 Next Launch and How Many Launches in 2026 and 2027

Blue Origin New Glenn 2 Next Launch and How Many Launches in 2026 and 2027

China's thorium reactor aims to fuse power and parity

China's thorium reactor aims to fuse power and parity

Ancient way to create penicillin, a medicine from ancient era

Ancient way to create penicillin, a medicine from ancient era

Goodbye, Cavities? Scientists Just Found a Way to Regrow Tooth Enamel

Goodbye, Cavities? Scientists Just Found a Way to Regrow Tooth Enamel

Scientists Say They've Figured Out How to Transcribe Your Thoughts From an MRI Scan

Scientists Say They've Figured Out How to Transcribe Your Thoughts From an MRI Scan

Calling Dr. Grok. Can AI Do Better than Your Primary Physician?

Calling Dr. Grok. Can AI Do Better than Your Primary Physician?

Inflation Watch: Countries Losing The Most Purchasing Power In 2025

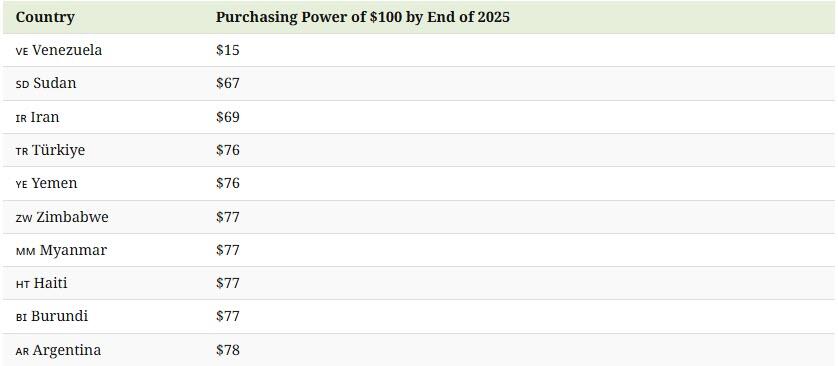

This graphic, created by Visual Capitalist's Jenna Ross in partnership with Plasma, highlights countries with the highest inflation rates and what $100 could be worth by the end of 2025. It's part of our Money 2.0 series, where we highlight how finance is evolving into its next era.

The Declining Value of $100 Due to Inflation

Some countries are facing high inflation rates, which means that prices are rising very quickly. As prices rise, money you already hold will buy you less than it did before.

What does this look like in dollar terms? Using projected 2025 inflation rates from the International Monetary Fund (IMF), we estimated what the equivalent of $100 at the start of the year will be worth by the end of 2025.

Source: IMF World Economic Outlook, Oct. 2025.

The IMF expects Venezuela will have an inflation rate of nearly 549% in 2025. In practical terms, this means $100 saved at the start of the year would only buy goods worth $15 by December. Economic sanctions from the U.S. have worsened the financial crisis in the country.

Even outside this extreme example, many countries are on track to see the local currency lose about a quarter of its purchasing power over the course of the year. This means wages and savings lose value quickly, making everyday essentials like food and rent harder to afford.

How to Protect Purchasing Power

When local money is rapidly losing purchasing power, residents can move their savings into a currency experiencing much lower inflation and more stability.

For instance, stablecoins are primarily pegged to the U.S. dollar and can help people preserve the value of their money. With Plasma One, a global U.S. dollar card, people can quickly sign up on their phone and use their stablecoin balance in more than 150 countries.

The Bloodbath is Here

The Bloodbath is Here Unbanked In A Connected World

Unbanked In A Connected World