Breaking News

I guess they're really going thru with it..

I guess they're really going thru with it..

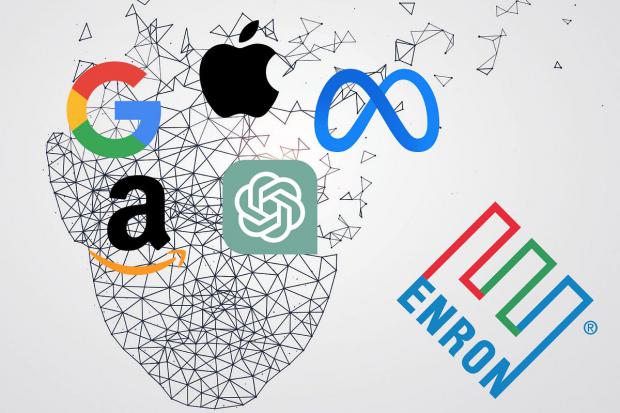

AI Stocks Are Pulling Enron-Style Accounting Tricks - Here's the Latest Example

AI Stocks Are Pulling Enron-Style Accounting Tricks - Here's the Latest Example

Doug Casey on Why Making $300,000 No Longer Means You're Secure

Doug Casey on Why Making $300,000 No Longer Means You're Secure

How CIA Money Becomes USAID Money. Case Study: The Asia Foundation

How CIA Money Becomes USAID Money. Case Study: The Asia Foundation

Top Tech News

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Look at the genius idea he came up with using this tank that nobody wanted

Look at the genius idea he came up with using this tank that nobody wanted

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

We've wiretapped the gut-brain hotline to decode signals driving disease

We've wiretapped the gut-brain hotline to decode signals driving disease

3D-printable concrete alternative hardens in three days, not four weeks

3D-printable concrete alternative hardens in three days, not four weeks

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

AI Stocks Are Pulling Enron-Style Accounting Tricks - Here's the Latest Example

In normal financial markets, earnings releases move stocks because of what a company did. Revenue was earned. Cash was generated. Margins expanded or contracted. Investors reward or punish companies according to actual, reported performance.

But in the current AI-driven market, that logic has gone out the window. And it seems like everyone is pulling out the 2000s accounting trick playbook.

Nothing proves this more clearly than what happened tonight with Marvell Technology ( MRVL -1.01%↓ ).

When Marvell first released its numbers, the stock dropped roughly -8% after-hours to $85 a share. It deserved to. The financials were weak: minimal GAAP profitability, a dependence on non-GAAP adjustments, and operating income that looked nothing like what one would expect from a supposed "core beneficiary of the AI data center boom."

But then the earnings call started — and something remarkable happened.

First totally synthetic human brain model has been realized

First totally synthetic human brain model has been realized Mach-23 potato gun to shoot satellites into space

Mach-23 potato gun to shoot satellites into space