Breaking News

Why men stopped going to church

Why men stopped going to church

Nullify the Police State: The People's Veto to Rein in a Lawless Government

Nullify the Police State: The People's Veto to Rein in a Lawless Government

Former Top CDC Officials Hired by California to Invalidate CDC's New Public Health Policies

Former Top CDC Officials Hired by California to Invalidate CDC's New Public Health Policies

James O'Keefe Reveals Shocking Details of Army of Anti-ICE Agitators...

James O'Keefe Reveals Shocking Details of Army of Anti-ICE Agitators...

Top Tech News

Researchers who discovered the master switch that prevents the human immune system...

Researchers who discovered the master switch that prevents the human immune system...

The day of the tactical laser weapon arrives

The day of the tactical laser weapon arrives

'ELITE': The Palantir App ICE Uses to Find Neighborhoods to Raid

'ELITE': The Palantir App ICE Uses to Find Neighborhoods to Raid

Solar Just Took a Huge Leap Forward!- CallSun 215 Anti Shade Panel

Solar Just Took a Huge Leap Forward!- CallSun 215 Anti Shade Panel

XAI Grok 4.20 and OpenAI GPT 5.2 Are Solving Significant Previously Unsolved Math Proofs

XAI Grok 4.20 and OpenAI GPT 5.2 Are Solving Significant Previously Unsolved Math Proofs

Watch: World's fastest drone hits 408 mph to reclaim speed record

Watch: World's fastest drone hits 408 mph to reclaim speed record

Ukrainian robot soldier holds off Russian forces by itself in six-week battle

Ukrainian robot soldier holds off Russian forces by itself in six-week battle

NASA announces strongest evidence yet for ancient life on Mars

NASA announces strongest evidence yet for ancient life on Mars

Caltech has successfully demonstrated wireless energy transfer...

Caltech has successfully demonstrated wireless energy transfer...

The TZLA Plasma Files: The Secret Health Sovereignty Tech That Uncle Trump And The CIA Tried To Bury

The TZLA Plasma Files: The Secret Health Sovereignty Tech That Uncle Trump And The CIA Tried To Bury

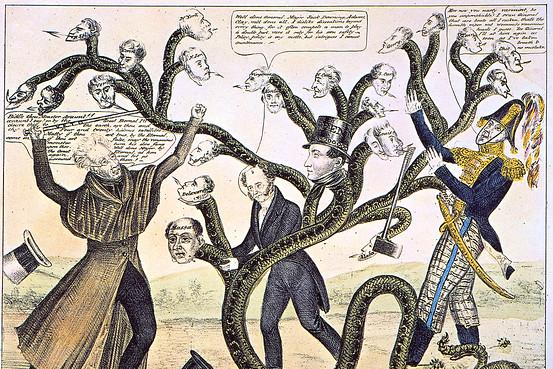

"The Bank Was Saved, and the People Were Ruined."

The panic had been caused when the First Bank of the United States had first expanded the money supply dramatically by offering loans, then contracted the money supply by tightening its requirements for new loans, causing a crash.

This is a useful quote, as, in its simplicity, it states the very nature of crashes brought on by irresponsible banking practices. In every case in which this occurs, it is possible through the complicity of the government of the day.

The origin of this syndrome goes back to Mayer Rothschild, a very clever fellow who, in the late 18th century, offered financial benefits to politicians in Germany in trade for political support for whatever activities his bank might practice. Rothschild was a long-term thinker; his method involved the offering of regular emoluments to politicians without their having to provide him with anything immediately. Then, when he needed a large favour, he would call it in.

Movie buffs may see a similarity between Rothschild's method and the deals made by Don Corleone in The Godfather. "Some day – and that day may never come – I'll call upon you to do a service for me."

Rothschild created boom-and-bust cycles which were highly profitable for his bank, but depended upon the support of the government when the "bust" part came along.

As described above, the bank would offer loans to the public on generous terms, then suddenly rein in those terms on all future loans. The claim the bank would make would be that inflation was taking place and the bank was taking action to control that inflation. (Of course, Rothschild did not bother to mention that it was the bank itself that had caused the inflation.)

The net result would be a "panic," or, in today's terms a "depression." Everyone involved would be harmed by the event except the politicians and the bank.

This scheme was accurately and succinctly described by G. Edward Griffin:

"It is widely believed that panics, boom-and-bust cycles, and depressions are caused by unbridled competition between banks; thus the need for government regulation. The truth is just the opposite. These disruptions in the free market are the result of government prevention of competition by the granting of monopolistic power to the central bank."

Mayer Rothschild's five sons followed in his footsteps and would go on to control much of the banking in Europe. The Rothschilds are perhaps best known for the Bank of England, which is still in operation today as one of the world's most powerful banks.