Breaking News

Red Light Therapy And Men's Health: Does It Really Work?

Red Light Therapy And Men's Health: Does It Really Work?

Kash Patel's New FBI Clown Show - The Bizarre Interview He Will Regret For The Rest of His Life

Kash Patel's New FBI Clown Show - The Bizarre Interview He Will Regret For The Rest of His Life

One Rifle I Trust for Everything

One Rifle I Trust for Everything

The West Coast Is Being Absolutely Pummeled By Trillions Of Gallons Of Rain, Wind Speeds Of Up...

The West Coast Is Being Absolutely Pummeled By Trillions Of Gallons Of Rain, Wind Speeds Of Up...

Top Tech News

This tiny dev board is packed with features for ambitious makers

This tiny dev board is packed with features for ambitious makers

Scientists Discover Gel to Regrow Tooth Enamel

Scientists Discover Gel to Regrow Tooth Enamel

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Advanced Propulsion Resources Part 1 of 2

Advanced Propulsion Resources Part 1 of 2

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

Dinky little laser box throws big-screen entertainment from inches away

Dinky little laser box throws big-screen entertainment from inches away

'World's first' sodium-ion flashlight shines bright even at -40 ºF

'World's first' sodium-ion flashlight shines bright even at -40 ºF

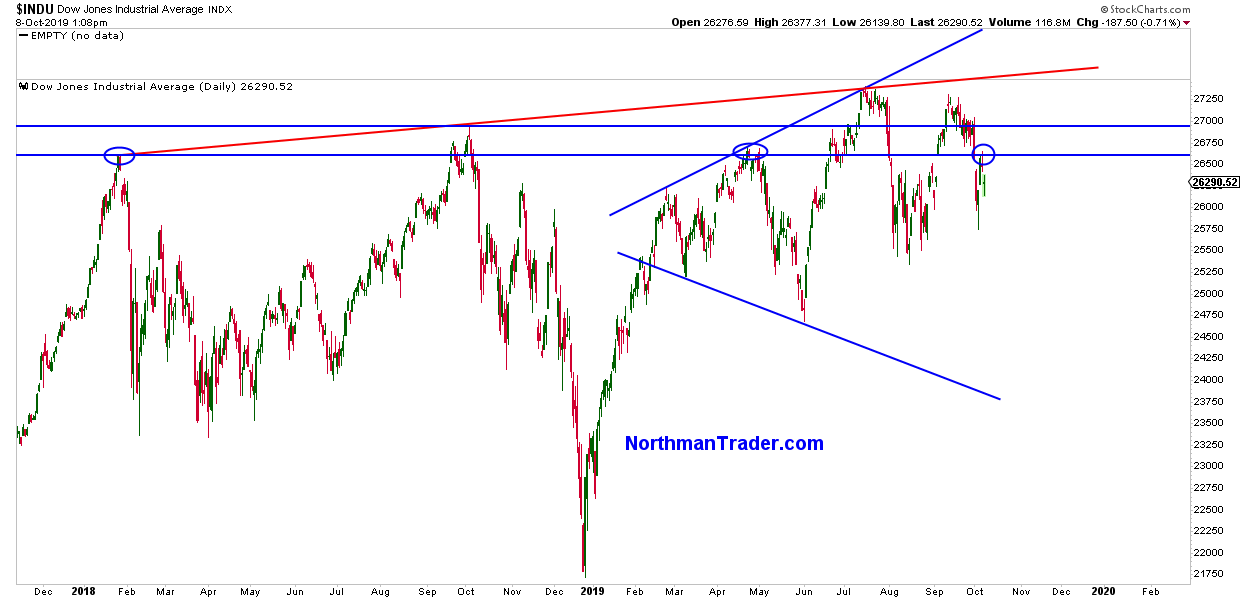

The Curious Case Of The Dow Jones Industrials Chart

The $DJIA chart is telling an interesting story, technically speaking that is. Frankly not sure what the message is quite yet, but I find it fascinating hence it might be of interest to share.

First of all, note a behavioral set of facts I've pointed out on twitter: On Monday $DJIA again tagged its January 2018 highs and has again rejected. All rallies to new highs have been selling opportunities. All rate cuts have been selling opportunities. Lower high in September, risk of a double top:

We see several relevant trend lines on the chart above and I could discuss these here, but I want to highlight something completely different and that is: Why is $DJIA rejecting these price zones above 26500?

Well, as it turns out, there is a technically relevant resistance point precisely at the October 2018 highs, the 2.618 fib from the 2009 lows and 2007 highs:

26948 on the futures contract. In fact, what's notable here is that $DJIA has tried 5 times to get above that zone on a monthly basis and has failed every single time to close above it by month end. Even the current October highs have tagged there and now rejected again.

Here's a close-up for clarity purposes: