Breaking News

Chairman Rand Paul Releases New Report Revealing Hundreds of Billions...

Chairman Rand Paul Releases New Report Revealing Hundreds of Billions...

Get Schiffy Music Video | Rick and Morty | Adult Swim

Get Schiffy Music Video | Rick and Morty | Adult Swim

Astrophysicist Dr. Willie Soon reminds us that "CO2 is the gas of life"...

Astrophysicist Dr. Willie Soon reminds us that "CO2 is the gas of life"...

Top Tech News

This tiny dev board is packed with features for ambitious makers

This tiny dev board is packed with features for ambitious makers

Scientists Discover Gel to Regrow Tooth Enamel

Scientists Discover Gel to Regrow Tooth Enamel

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Advanced Propulsion Resources Part 1 of 2

Advanced Propulsion Resources Part 1 of 2

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

Dinky little laser box throws big-screen entertainment from inches away

Dinky little laser box throws big-screen entertainment from inches away

'World's first' sodium-ion flashlight shines bright even at -40 ºF

'World's first' sodium-ion flashlight shines bright even at -40 ºF

How To Retire US Debt, Monetize Assets, Help Americans Hedge Financial Risks and Keep...

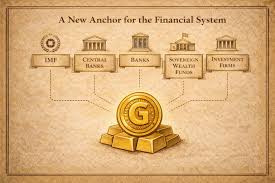

Balance-Sheet Event With Monetary Consequences

Recent sovereign gold token announcements are often framed as experiments in digital payments or crypto infrastructure. That framing understates what is taking place. What is emerging is a shift in how sovereign balance sheets are managed. Gold, when paired with blockchain rails, is becoming a programmable monetary instrument that operates alongside fiat currencies (SOV asset) rather than in place of them as a settlement medium currency.

The developments in Bhutan and Kyrgyzstan point toward a broader direction. Nations are preparing to monetize existing assets to manage debt, inflation, and external monetary risk. Gold and silver sit at the center of that strategy.

The Re-Emergence of Dual Money

Historically, monetary systems operated in layers. Sovereign money and domestic money existed simultaneously, each serving a different function. Gold and silver anchored external obligations and inter-sovereign settlement. Domestic currencies circulated internally and adjusted to political and economic needs.

A similar structure is forming again.

In the modern version, fiat currency remains the medium of exchange. Gold assumes a balance-sheet and informational role. The mechanism differs from earlier systems in how value is established. Pricing now emerges continuously through markets rather than episodically through proclamation.

Gold does not need to circulate to exert influence. Visibility, accessibility, and credible pricing are sufficient.

Tokenized Gold as a Sovereign Instrument

Sovereign gold tokens function as state-backed monetary instruments. They are issued against existing reserves and designed to operate within regulated frameworks.

The mechanics are straightforward:

A sovereign allocates gold already held on its balance sheet.

Claims on that gold are tokenized.

Citizens or institutions exchange fiat for those claims.

The gold remains in custody.

Currency is absorbed from circulation.

This process converts gold from a passive reserve into an active balance-sheet asset. Fiat liabilities decline without the sale of physical gold, without additional borrowing, and without forced fiscal tightening.

Fireballs are coming

Fireballs are coming