Breaking News

Wash Post Editorial Board Turns Against Climate Agenda?!

Wash Post Editorial Board Turns Against Climate Agenda?!

One Year Ago I Predicted and Described in Detail Huge Mars AI Plans that Elon Musk Confirmed...

One Year Ago I Predicted and Described in Detail Huge Mars AI Plans that Elon Musk Confirmed...

British Teachers To "Spot Misogyny" In Boys And Target Them For Reeducation

British Teachers To "Spot Misogyny" In Boys And Target Them For Reeducation

Democrats Refuse To Release Post-Mortem Of 2024 Election Loss, DNC Chair Says

Democrats Refuse To Release Post-Mortem Of 2024 Election Loss, DNC Chair Says

Top Tech News

This tiny dev board is packed with features for ambitious makers

This tiny dev board is packed with features for ambitious makers

Scientists Discover Gel to Regrow Tooth Enamel

Scientists Discover Gel to Regrow Tooth Enamel

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Advanced Propulsion Resources Part 1 of 2

Advanced Propulsion Resources Part 1 of 2

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

Dinky little laser box throws big-screen entertainment from inches away

Dinky little laser box throws big-screen entertainment from inches away

'World's first' sodium-ion flashlight shines bright even at -40 ºF

'World's first' sodium-ion flashlight shines bright even at -40 ºF

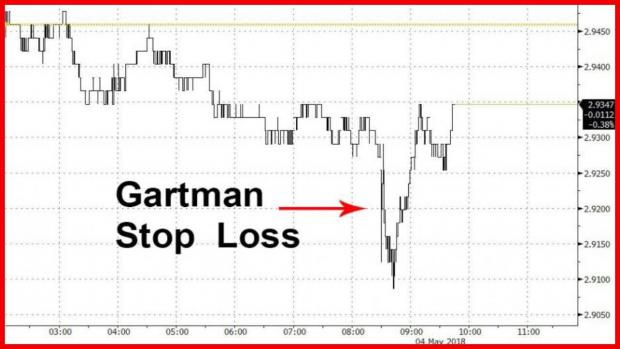

Gartman: "A Global Bear Market Of Some Very Real Consequence Is Developing"

Alas, as so often happens, it didn't turn out quite as expected, and as the world-renowned commodity guru writes in his note today, half of his bond holdings are now history":

In our retirement account, we did take some action yesterday given the weakness in the US bond market following the surprisingly stout ADP report and we sold about half of our bond position right on the opening, and swapped that bond position for a position once again in the shares of the US largest producer of ball bearings… the ultimate stock of a company that produces "the things that if dropped on your foot shall hurt," for what is more central to economic growth than ball bearings? We bought a correction and our risk is only to the lows of last week. We still retain other bond and/or bond like positions and we are still long of gold.