Breaking News

Wash Post Editorial Board Turns Against Climate Agenda?!

Wash Post Editorial Board Turns Against Climate Agenda?!

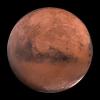

One Year Ago I Predicted and Described in Detail Huge Mars AI Plans that Elon Musk Confirmed...

One Year Ago I Predicted and Described in Detail Huge Mars AI Plans that Elon Musk Confirmed...

British Teachers To "Spot Misogyny" In Boys And Target Them For Reeducation

British Teachers To "Spot Misogyny" In Boys And Target Them For Reeducation

Democrats Refuse To Release Post-Mortem Of 2024 Election Loss, DNC Chair Says

Democrats Refuse To Release Post-Mortem Of 2024 Election Loss, DNC Chair Says

Top Tech News

This tiny dev board is packed with features for ambitious makers

This tiny dev board is packed with features for ambitious makers

Scientists Discover Gel to Regrow Tooth Enamel

Scientists Discover Gel to Regrow Tooth Enamel

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

A microbial cleanup for glyphosate just earned a patent. Here's why that matters

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Japan Breaks Internet Speed Record with 5 Million Times Faster Data Transfer

Advanced Propulsion Resources Part 1 of 2

Advanced Propulsion Resources Part 1 of 2

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

PulsarFusion a forward-thinking UK aerospace company, is pushing the boundaries of space travel...

Dinky little laser box throws big-screen entertainment from inches away

Dinky little laser box throws big-screen entertainment from inches away

'World's first' sodium-ion flashlight shines bright even at -40 ºF

'World's first' sodium-ion flashlight shines bright even at -40 ºF

The last time a president installed a "shadow Fed chair," inflation hit 12%.

This week, on Wednesday, the Fed cut rates. This, however, is NOT the story. We all knew that was coming.

The story is three dissents — the most in six years — split in opposite directions.

Hawks and doves BOTH objecting.

Powell admitted he could "make a case for either side."

The institution that is (theoretically) responsible for price stability can't agree on what price stability requires.

And it may get worse. Why?

Because Powell's term ends May 2026.

Trump will name a replacement months early.

Treasury Secretary Bessent already coined the strategy: create a "shadow chair" so "no one is really going to care what Jerome Powell has to say anymore."

The issue, in short, is that if the Fed appears disordered, and the Chair doesn't have any authority, then determining what the forward-looking plan is becomes vastly more difficult.

And like everything in history, my friends, there IS a historic parallel.

1970: Nixon appoints Arthur Burns with explicit expectations for easy money before the '72 election.

From the Nixon tapes — yes, we have the recordings — Burns calls Nixon to report rate cuts.

Nixon's response: Great, and "I really don't care what you do after April."

Burns kept rates low. Nixon won in a landslide.

By 1974, inflation hit 12.3%. It took Volcker raising rates to 15.6% and accepting 10%+ unemployment to fix it. The "Nixon-Burns boom-bust cycle" took a decade to unwind. Here's what the research shows: Political pressure on the Fed "strongly and persistently raises inflation and inflation expectations but has little impact on economic activity." (Per a 2024 Research Report by UMD - DM me if you want the link) You get the inflation without the growth. A divided Fed with a lame-duck chair and a shadow successor means one thing: less confidence in what the Fed says or does. Markets lose their anchor. Capital allocation gets harder. And the future gets even murkier (as if it wasn't already). Make sure to subscribe to the Timeless Investor to get a good flow of relevant modern-day and historical analysis.