Breaking News

Here's Why It's Time For The Police To Question Erika Kirk… | Candace Ep 305

Here's Why It's Time For The Police To Question Erika Kirk… | Candace Ep 305

The Proof of Persona: Decoding Patent 060606 and the Mining of the Human Soul

The Proof of Persona: Decoding Patent 060606 and the Mining of the Human Soul

Bill Maher APOLOGIZES To QAnon!

Bill Maher APOLOGIZES To QAnon!

Mama's Boy? Sam Bankman-Fried, Represented By His Mother, Files For New Trial In FTX Implosion C

Mama's Boy? Sam Bankman-Fried, Represented By His Mother, Files For New Trial In FTX Implosion C

Top Tech News

Drone-launching underwater drone hitches a ride on ship and sub hulls

Drone-launching underwater drone hitches a ride on ship and sub hulls

Humanoid Robots Get "Brains" As Dual-Use Fears Mount

Humanoid Robots Get "Brains" As Dual-Use Fears Mount

SpaceX Authorized to Increase High Speed Internet Download Speeds 5X Through 2026

SpaceX Authorized to Increase High Speed Internet Download Speeds 5X Through 2026

Space AI is the Key to the Technological Singularity

Space AI is the Key to the Technological Singularity

Velocitor X-1 eVTOL could be beating the traffic in just a year

Velocitor X-1 eVTOL could be beating the traffic in just a year

Starlink smasher? China claims world's best high-powered microwave weapon

Starlink smasher? China claims world's best high-powered microwave weapon

Wood scraps turn 'useless' desert sand into concrete

Wood scraps turn 'useless' desert sand into concrete

Let's Do a Detailed Review of Zorin -- Is This Good for Ex-Windows Users?

Let's Do a Detailed Review of Zorin -- Is This Good for Ex-Windows Users?

The World's First Sodium-Ion Battery EV Is A Winter Range Monster

The World's First Sodium-Ion Battery EV Is A Winter Range Monster

China's CATL 5C Battery Breakthrough will Make Most Combustion Engine Vehicles OBSOLETE

China's CATL 5C Battery Breakthrough will Make Most Combustion Engine Vehicles OBSOLETE

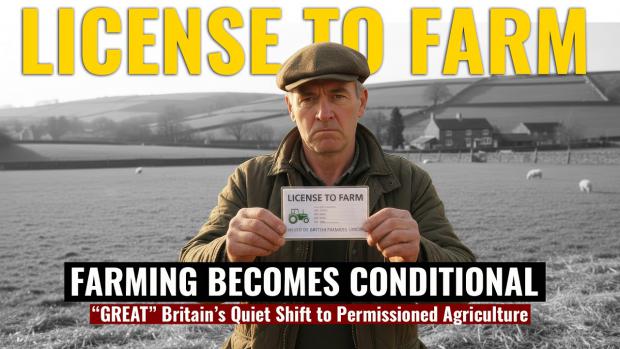

LICENSE TO FARM | Great Britain's Quiet Shift to Conditional Agriculture.

A rare court move signals deeper trouble

In early 2026, the UK High Court quietly did something it almost never does in tax cases: it ordered an urgent, two-day rolled-up judicial review of changes to inheritance tax reliefs affecting farms and family businesses.

A rolled-up hearing — where the court hears both permission to proceed and the full merits at the same time — is typically reserved for cases the judiciary believes are procedurally serious, time-sensitive, and potentially harmful if delayed. It is unusual in the tax context, where courts normally defer to Parliament and the Treasury.

The challenge targets reforms announced in the 2024 Budget by Rachel Reeves, which capped long-standing inheritance tax reliefs for agricultural and business property. The claimants argue the government broke its own tax-policy standards by pushing through a major structural change without proper consultation or impact assessment.

The court has not ruled on the substance yet. But the decision to fast-track the case is itself a signal: this is not being treated as routine fiscal housekeeping.

Where the "licence to farm" warning enters the picture

The inheritance tax fight is only one half of the story.

Running in parallel — and largely outside the courtroom — is an expanding framework of environmental permitting for livestock operations, overseen by DEFRA and enforced by the Environment Agency, with devolved equivalents elsewhere in the UK.

At present:

Large dairy and beef units already require environmental permits

Permits regulate slurry storage, nutrient runoff, ammonia emissions, and water pollution

Non-compliance can lead to fines, suspension, or shutdown

What is changing is scope and ambition.

Policy discussions, consultations, and NGO modelling increasingly frame cattle farming through the lens of industrial emissions control — methane, ammonia, nitrates — rather than traditional land stewardship. Proposed tightening of standards would extend permitting requirements to a wider range of livestock operations and impose higher compliance costs.

There is no single law called "Licence to Farm."

But permits determine who may operate, under what conditions, and at what cost.

For farmers, the concern is not semantic. It is structural.